Crypto Then, Crypto Now

As I pursue the next chapter in my career, I wanted to flesh out my thoughts.

Disclaimer: The opinions expressed are my own and do not reflect the views of any organization or fund I have been employed by, or associated with. This post is shared in a personal capacity and should not be construed as investment, legal, or financial advice.

I originally drafted this piece in October, but have not been able to publish it thus far. Since then, it’s been fascinating to see how consensus some of this has become (Dougie De Luca and Santiago Santos both hit similar notes). The market moves quickly! I figured I’d still post it because some may find it informative, and it helps me align on what’s next. Oh, also, this wasn’t written by AI - if you know my writing style, you know this is all analog.

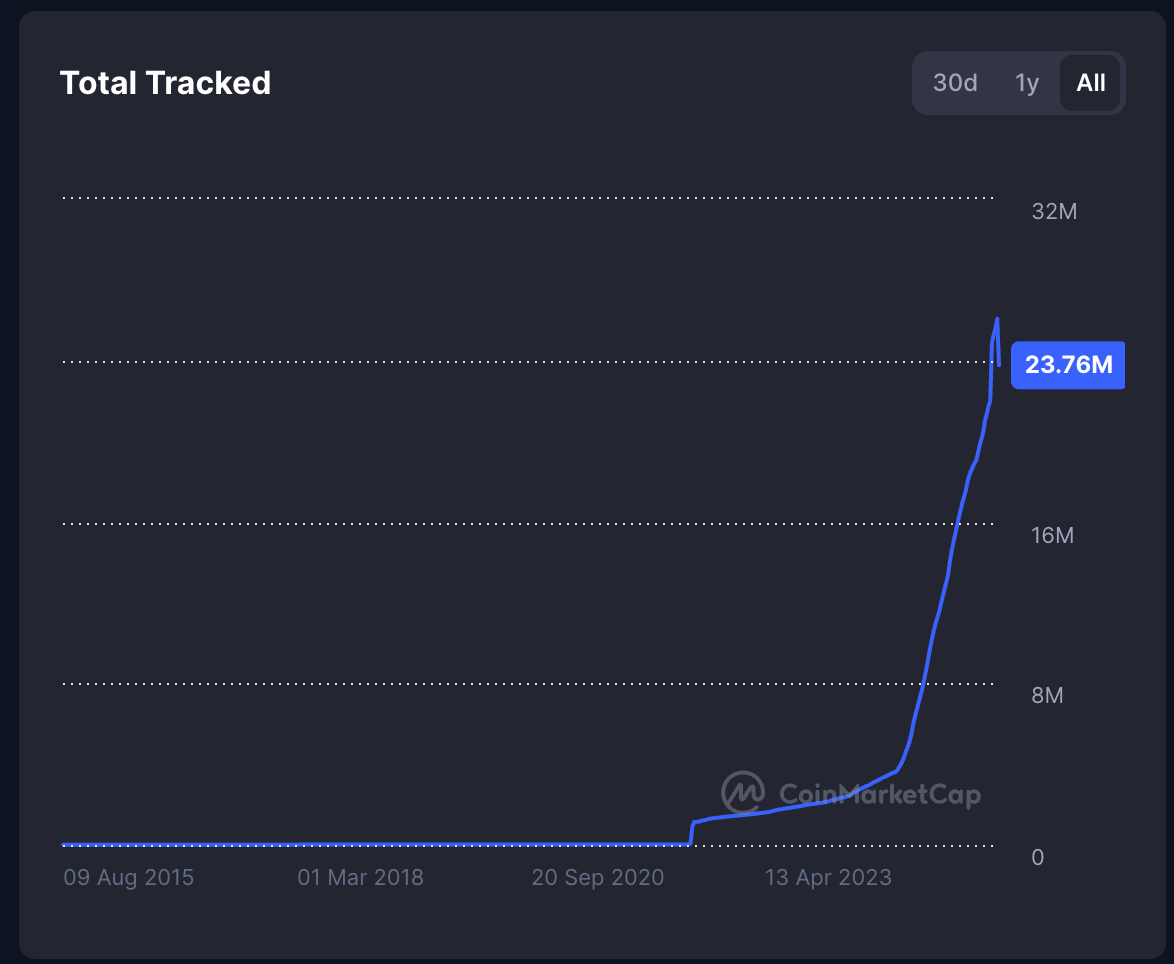

Sentiment in crypto is clearly bad. This is the total crypto marketcap excluding BTC, ETH, and Stablecoins as of December 15th, 2025:

It looks…not horrible at first glance? The chart seems constructive over a long enough timeframe. Sure, the total marketcap of “alts” is the same as it was in April 2021 (which has been frustrating for many who were late to the game…which I’d argue is past class of 2020/2021).

But when you put it in the context of this next chart (total tokens launched tracked by Coinmarketcap):

# of tokens launched over time:

This meme starts to come to mind for the price of a given token:

This is obviously a gross oversimplification. Most of these token launches are memecoins that never came close to drawing in real money - but we are dealing with a numerator that isn’t expanding as fast as the denominator for alts generally. New launches (ex HYPE) just aren’t working. The air has been coming out of alts for years now, with brief periods of reprieve - and that’s what you’re seeing on crypto twitter. Liquidations, crashouts, infighting. All signs of the times.

The reality is that the industry isn’t dying, it’s just evolving. Crypto’s role as a counterculture, niche industry serves only the constituents who joined extremely early. Continued growth necessitates mainstreaming and corporatization. “The institutions are coming” can only mean one thing. More on that later.

Who am I? Just a guy writing his thoughts down in a period of transition. But I will give you a bit of context on my journey in crypto.

I properly fell down the Bitcoin rabbit hole in 2020. At a time when the government was printing an eye-watering amount of money, not handling the response to a global pandemic particularly well, and pretending inflation wasn’t real (to an insulting degree), the thesis of Saylor, Dorsey, Ross Stevens, and others occupied ever more of my brain space. I couldn’t “unsee it”.

There was certainly an element of identity that became tied in. Others couldn’t see what I could see so clearly. But my “tribe”...they also saw it. Being contrarian, and the market telling me I was right, felt good. Like the social cause du jour, being into crypto gave a sense of belonging and community - though that’s a prompt for a different essay. One thing led to another, and I have spent the past 5 years in and around the crypto industry. Most recently, I spent ~4 years investing in the space as a venture capitalist. I saw countless friends, peers, and acquaintances take treks to varying depths of the rabbit hole, most of them brief. Handling the volatility and FUD of the industry is no simple endeavor. My professional background (pre-crypto) is in L/S TMT equities, and at different points in my crypto journey I’ve had different investing caps that felt appropriate to wear.

The point of this piece, more than anything, is for me to put my thoughts on paper as I figure out what is next for me. Maybe it will resonate with others, maybe others will find it interesting. The key things I want to reflect on are:

What is great about crypto?

What is not great about crypto?

How did the industry work and what has crypto’s role in society been?

What’s changing? How will crypto look?

Most importantly, what do I really believe (and did I waste my time)?

1: What is great about crypto?

Blockchains are a structural improvement in commerce.

At the core of the concept, blockchains allow two parties to transact without requiring trust. This has downstream effects on every transaction, monetary or not. Where trust is required, a blockchain should be the back end. It will take time for the technology to harden and the coordination of existing power structures to adapt - but we will get there. Think elections, think deeds, think loans, think AI. Trust machines should have a prominent place in a world where nobody trusts anyone or anything they come across. Everyone reading this can conjure a cumbersome process in their life where they would love to streamline it and remove middlemen. That’s how extensible it is. It’s relevant to everyone and every aspect of life and is one of the reasons I got so excited about the space in 2020.

Crypto has provided, and will continue to provide, essential banking services to anyone with an internet connection.

There isn’t much to expand upon here, and cynics would point out ways it’s also harmed said individuals (or a different cohort). Sure - it’s not all rosy, but allowing anyone, anywhere in the world to hold US dollars and a little Bitcoin is a powerful impact.

Tokens are a fantastic means of (theoretical) incentive alignment.

Allowing the earliest evangelists, users, and capital providers to participate in the value creation of an enterprise, simply rocks. It’s something that should be allowed more broadly, and I saw it happening en masse in crypto. It was first prevalent in DeFi, then gaming, and quickly pervasive. Projects and protocols were able to spin up desired flywheels by rewarding users and participants with tokens. The users and participants shared in the success of the projects and protocols, and there was a relationship which is symbiotic in theory. Putting aside practice, which I will address in uhhh…a different section, the concept is fantastic. It’s egalitarian, and we still see positive, life changing outcomes for true advocates, users, and projects/protocols today (most notably Hyperliquid).

Crypto has leveraged regulatory arbitrage to enable categories of products and services that people WANT

A lack of clear rules of the road in concert with brilliant, risk tolerant minds has allowed for much experimentation. The result is new primitives. Polymarket is where news happens. Hyperliquid (and Dydx/GMX before it) was the trojan horse for the perp-ification of all markets - which is coming. Tether, Circle, Maker, et. al, to some extent, have relied on gray areas to bring stable mediums of exchange to everyone who could possibly want them.

Bitcoin is awesome

If you don’t believe me or don’t get it, I don’t have time to try to convince you, sorry. I’ll wrap this section by saying that Bitcoin is awesome for the reasons it always has been. Those who have been close to me through my journey know that I’ve gone through various phases of doubt as it pertains to the meme/religion that is Bitcoin, but it’s hardened into something that I’ve come to conclude is inevitable save for some edge case. That doesn’t mean every other asset on the planet sucks (sorry maxis). It just means that Bitcoin is also a good one.

2: What is not great about crypto?

I’m going to skip the leverage blow up of 2022 (LUNA, FTX, Celsius, Genesis, etc.) - that was obviously “not great” but has been well covered. The purpose of this piece is to think through the state of the state (and future state), not to give more air to bad actors and events of the past.

That hot ball of money is pretty fast. And it’s not growing.

2021 cycle: PFP NFTs, metaverse, play-to-earn, move-to-earn, DAO mania, DeFi 2.0, social tokens

2024 cycle: decentralized GPUs, restaking, AI agent tokens, BTC L2s, “perp” meta, “neobank??” meta

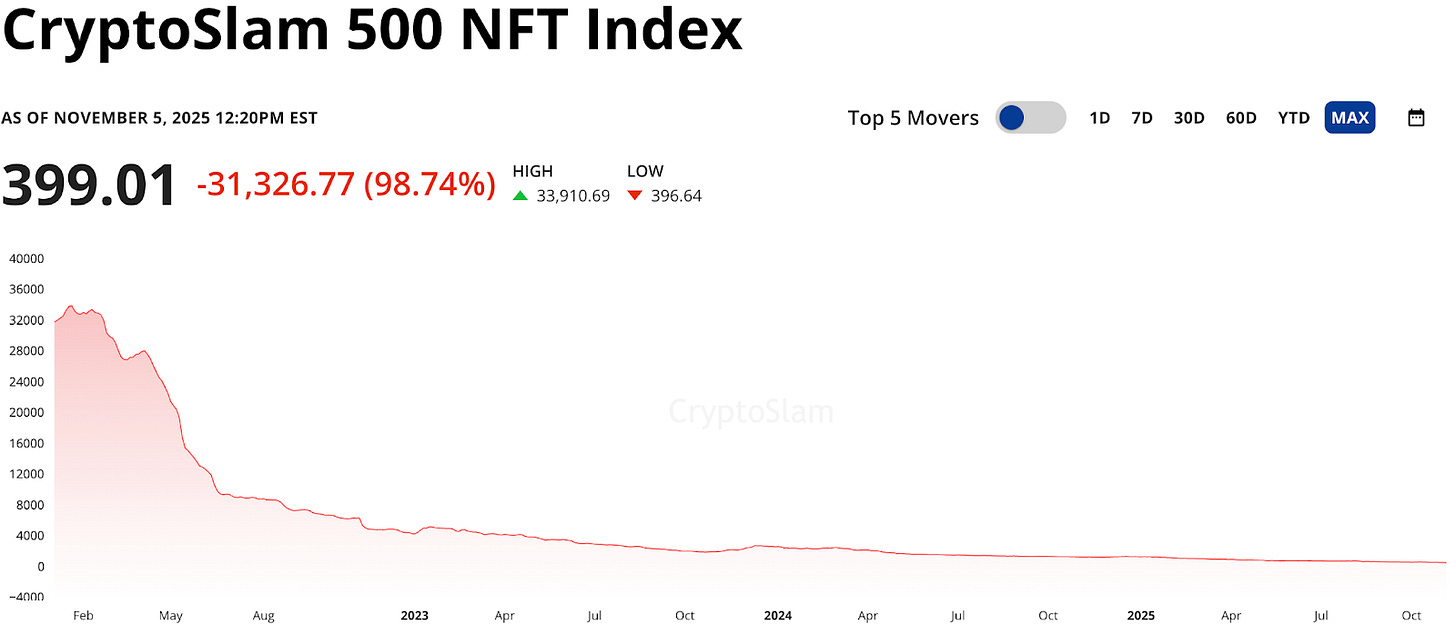

You may have no clue what those words mean, but a picture’s worth 1000 words:

PFP NFTs:

Metaverse: Decentraland ($MANA):

Play-to-earn: Axie Infinity ($AXS):

A few from more recently:

Decentralized GPUs: IOnet ($IO):

AI Agents: AI16z ($ai16z):

Restaking: Renzo ($REZ):

You get the point…the strong majority of charts look like this on a long enough time frame. If you use a random token selector and pull up an all-time chart, it’s down and to the right with near certainty. It’s not ALL of them, and the global maxima are part of what keeps capital intrigued. The ones that don’t look like this represent such a boon that participants continue to stay in the arena. Even the projects which have been extremely successful (with continuous growth) don’t look all that great:

Lido is a liquid staking provider that pioneered a category and still has ~$26bn in TVL (or AUM for non-crypto natives). That figure has almost doubled since this time in 2023. DefiLlama tells me that it generates ~$750bn in fees annualized, and ~$75mm in revenue annualized. The marketcap and FDV (~the same figure as it’s fully circulating) sit around $544mm.

Here’s a chart of it’s key KPI:

Here’s a chart of its token price:

Is this the chart of an uber successful [non-L1] protocol in crypto? Why does it look down and to the right? When thinking about token comps, this is one that presents issues. $26bn of TVL is a heroic achievement for any protocol! How have we valued these tokens? What world of token valuation are we moving toward?

On one hand, I would be remiss to not point out that the shapes of these charts resemble some liquid mark-to-market version of a basket of random startups in general. Most startups fail! Maybe even after initial success or capital raising endeavors. They just fail before there’s a liquid market for the equity. There are also pockets of durable value creation in the industry. Bitcoin has “made it”, Stablecoins and the surrounding infrastructure have “made it”, prediction markets have “made it”, perps are “making it”, the tokenization of all other assets is “making it”. There are still all kinds of experimental applications that are promising and worth monitoring - and might make it in the future.

On the other hand, the first chart of this piece showed that there has been no growth in market cap of alts over the past 4+ years - which can only mean it’s PvP. The WAGMI thesis has been dismantled thoroughly. The hot ball of money is burning less and less bright.

If you’re sensing a dichotomy, you’re on the right track.

Tokens in their current form are a poor means of (practical) incentive alignment

What began as an elegant way to instantiate network effects while rewarding network participants has devolved into a mercenary, transient, extractive handshake deal. This is consensus at this point, but I’ll list the ingredients below, then make the recipe.

There are a very limited amount of crypto users (by that I mean onchain degens)

There is a limited amount of capital onchain

Crypto users are entitled, but valuable

There is a steep valuation premium associated with various narratives and ecosystems

The path to (quick) liquidity for insiders is dependent on inflecting KPIs and attention

When you mix this all together, here’s what you get:

Founders building in the right narrative or ecosystem know that their window for liquidity is short, but if you can time it right, there is a massive premium. They need the attention, usage, and capital from industry participants. They issue token incentives for capital or usage, which users flock to and evangelize online (attention). The project/protocol gains hype and everyone is excited. They airdrop their token to their evangelists, list the token on centralized exchanges at an absurd premium with very little float. Then, the “evangelists” sell the tokens they acquired, in many cases becoming adversarial because they don’t feel they got enough tokens or the token didn’t perform well, and the metrics of the protocol roll over. They move onto the next one, leaving the protocol for dead. There’s no buyer to step in, and only supply coming to the market for the foreseeable future.

It’s mercenary, it’s extractive, and sets a business up for failure. At the root of the issue: the main reason the customers use a product/service is to make a quick buck. The incentive alignment is transient at best, and the reward is the product itself rather than a sweetener.

3: How did the industry work and what has crypto’s role in society been?

From what I can tell and how I got involved (I’m no OG), the industry flourished based on future promise. From a fundamental perspective (set aside a few), the value of an asset lies in its future cashflows. So this is broadly how a fledgling, nascent tech vertical should be considered.

But the range of outcomes was so enormous. The stories to be told were powerful ones, splayed over decades. They were (and still are!) captivating ones. The mystery introduced uncertainty to valuations - and allowed one to “dream the dream”. There wasn’t anything like a cryptoasset before - and the early proof was in the performance of cryptoassets. Cue: “everyone is getting hilariously rich and you’re not” headline. The marketcap was so tiny, that even small, experimental (in tradfi terms) flows impacted the market structure meaningfully. BTC was the future of money. But maybe it was more of a store of value, but maybe ETH was too and it was a better one because it was productive? Or maybe SOL was a better ETH and therefore BTC? The swim lanes for asset categorization within crypto hadn’t been developed, let alone solidified. The wealth effect from BTC and ETH spilled into one narrative after another while the government and central banks inflated assets away. There was strong correlation between BTC and the rest. The patterns were discernible (BTC->Majors->Alts), and everything went up at the same time, regardless of merit. Each cycle there was a different mode of clever financial engineering. In the 2021 cycle, it was bad leverage. This cycle, it’s (in part) digital asset treasuries (DATs).

In sum, the degree of unknowns allowed one to suspend reality at a time when society (will focus on the United States because that’s where I’m from) accelerated its accumulation of negative capital. What’s the answer? Well…in part socialism…it seems the all-in guys were right. But I’ll leave that for someone else to opine on. The answer is also, in part, the nihilism thesis that has become pervasive. And I do believe that crypto afforded the most credible way to catch up quickly.

4: What’s changing? How will crypto look?

Generally speaking, incrementally obfuscated and “boring”…if I had to be pithy about it. There will always be ample room for experimentation and innovation. Crypto is conforming to the world, not vice versa. The marginal dollar flowing into the space is going to the areas of crypto that are demonstrably solving problems, and will be used by the largest institutions. And readers may say wow this guy is bearish crypto. But I’m not bearish on the category AT ALL. Maybe I’m bearish those who play today’s games, expecting outcomes of the past? Growing pains are still pains. A rising tide has lifted very few crypto boats since the bastion of capitalism elected a “crypto” president who leaned in rather than attacked the industry. And the natural conclusion to me is that the role of any given crypto token or business will be commensurate with the value it provides to society writ large. The opacity premium is washing out, and I think that’s healthy. Does that mean there isn’t room for the hallowed “L1 premium”, for example? Not necessarily. The prize will be (and should be) massive for whoever builds the most credibly neutral, performant settlement layer. There has been much debate on this particular point since I originally drafted this, and others have fleshed out more coherent theses than I have. I’ll leave that to them. Some in the industry refer to the latest trend as the “revenue meta”, which is humorous. How is it a meta that businesses must generate revenue (and eventually profit) to be valuable?

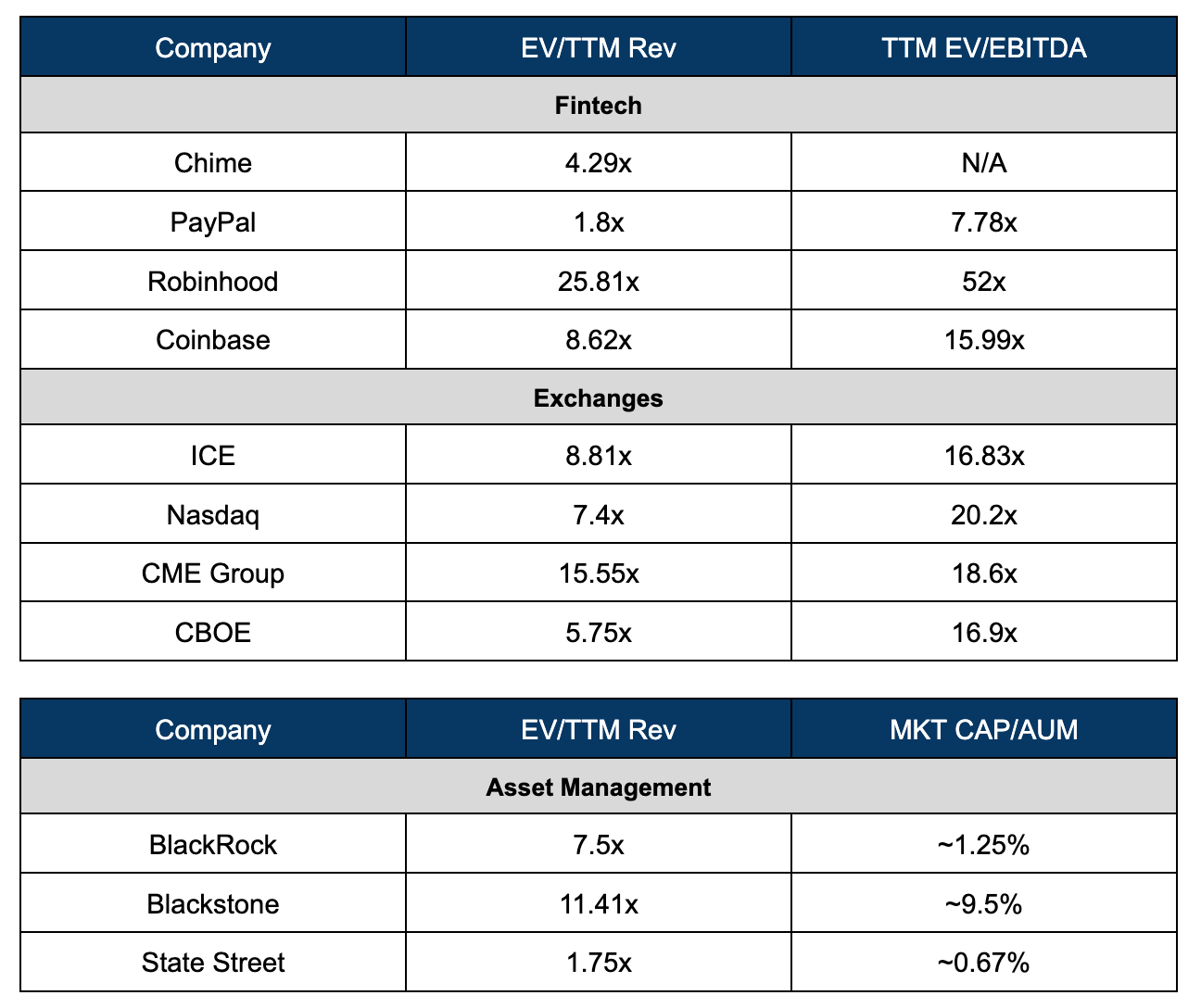

It’s also notable that many (not all!) of the onchain applications are financial in nature, and from a fundamental perspective, they resemble asset management or traditional exchange business models (% of volume or % of AUM). Here are some illustrative comps (as of Dec 15 from Yahoo Finance):

The “so what” of this? Maybe Lido trading at just north of 2% of AUM is actually rational. And yes, there’s always room for multiple expansion for innovators within crypto just like there is in traditional markets (see: HOOD multiple). There will be pockets of irrationality and momentum, just like there are in traditional markets (see: XRP, ADA, ZEC). Dispersion in the crypto market (token instruments, equity instruments, or otherwise) is here to stay, and market participants will need to adjust. In past cycles, cash returned from venture investors was skewed overwhelmingly toward token instruments, but this has been evening out and will continue to - the instrument should not matter.

5a: Did I waste my time?

This section is a late addition. I’ve seen so much written on the topic in recent weeks and wanted to figure out how I think about it. When I decided to join the industry, I leaned heavily on the concept of regret minimization. I had strong conviction in the thesis that decentralized blockchains would affect every aspect of commerce and society, and that an industry-wide venture style outcome (10x+ over 5-10 years) was probabilistically likely. From April 2021, as demonstrated in the opening chart, that hasn’t YET played out. Let’s set aside the fact that it still very well might, and consider the reality that it hasn’t yet.

If you didn’t have a strong thesis when you joined, well, you shouldn’t have. If you had a strong thesis, and it hasn’t played out in the way you thought it would, well, you’re just wrong. And that’s what life is about: making decisions with conviction and then adapting to perceived or realized outcomes. Maybe you were wrong about the initial use cases/PMF and that upsets you. Maybe you were wrong about the market size, time horizon, or value accrual/valuation frameworks, or the ethos (e.g. cypherpunk vs. institutional plumbing). Whatever the case, complaining about a perceived outcome or evolution of the industry is an indictment of one’s sovereignty and accountability.

I, personally, firmly believe I did not waste my time in this phase of work. I worked with, and learned from, brilliant colleagues and entrepreneurs. I got to have a front row seat to so many exciting projects and businesses. I also got a front row to seat to the maturation of a nascent industry. I questioned how the world works in ways I previously hadn’t. I got a crash course in psychology and markets that only crypto can provide.

5b: What do I really believe?

Looking forward in crypto, there’s a ton to be genuinely excited about. US regulatory bodies have given the nod, which allows for institutions of all kinds to participate (and importantly acquire). Entrepreneurs can build without worrying about being sued for delivering non-predatory products in the category. Legislation has already been passed, with more to come next year. Stablecoins will continue to proliferate, which will expand the “GDP” on blockchains and showcase the composability they bring. Assets of all kinds will be tokenized and brought onchain. Perps and prediction markets will be everywhere and used by everyone. Bitcoin will keep being Bitcoin. What will the next product or category of crypto that reaches 100mm+ people be? I don’t know for sure, but I’m confident it’s going to come packaged in an incrementally “obfuscated and boring” box. Could it be identity tokens that power agents under the hood? Could it be on the backend of X posts for provenance? Could it be a prediction market aggregator? Or something built on HIP-3?

Here is what I am sure I believe (and yes the leaves below are of the tea variety):

The game on the field has permanently changed.

The tooling and “permission” required for regular companies to build on blockchains are there.

Incentive alignment is powerful if done correctly. Community ownership still matters.

More people need access to various asset classes in non-predatory ways.

We are rapidly approaching a world in which everything has a market/price.

Assets are going to be tokenized and onchain (dollars were just first).

Feel free to DM me if you want to jam or catch up. More to come. Wen? Soon.